idaho sales tax rate

The total tax rate might be as high as 9 depending on local municipalities. The Idaho ID state sales tax rate is currently 6.

State Corporate Income Tax Rates And Brackets Tax Foundation

Depending on local municipalities the total tax rate can be as high as 9.

. This includes hotel liquor and sales taxes. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 3. Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales.

The state also is providing a one-time tax rebate. Acequia ID Sales Tax Rate. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

There are a total of 124 local tax jurisdictions across the state. 2020 rates included for use while preparing your income tax deduction. The Idaho sales tax rate is currently.

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3. The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006. Some Idaho resort cities have a local sales tax in addition to the state sales tax.

Idaho sales tax rate. Local level non-property taxes are allowed within resort cities if approved by 60 majority vote. Aberdeen ID Sales Tax Rate.

278 rows 2022 List of Idaho Local Sales Tax Rates. What is the sales tax rate in Idaho City Idaho. The minimum combined 2022 sales tax rate for Boise Idaho is.

Integrate Vertex seamlessly to the systems you already use. In comparison to local-level tax rates in other states. Cities with local sales taxes.

Idaho has reduced its income tax rates. The latest sales tax rate for Boise ID. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected.

City Total Sales Tax Rate. The Boise Sales Tax is collected by the merchant on all qualifying sales made within Boise. Lowest sales tax 6 Highest sales tax.

The state sales tax rate in Idaho is 6 but you can. Depending on local municipalities the total tax rate can be as high as 9. The maximum local tax rate allowed by Idaho law is 3.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. These local sales taxes are sometimes also referred to as local option taxes because the taxes are decided by the voters in the community affected. ID Rates Calculator Table.

Idaho enacted its sales and use tax in 1965 and it was approved by the electorate during the 1966 election. Non-property taxes are permitted at the local level in resort cities if a 60 percent majority vote is obtained. Lower tax rates tax rebate.

You can lookup Idaho city and county sales tax rates here. This is the total of state county and city sales tax rates. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Prescription Drugs are exempt from the Idaho sales tax. What is the sales tax rate in Boise Idaho. While many other states allow counties and other localities to collect a local option sales tax Idaho does not permit local sales taxes to be collected.

Ada County ID Sales Tax Rate. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0 to 3 across the state with an average local tax of 0074 for a total of 6074 when combined with the state sales tax. 31 rows The state sales tax rate in Idaho is 6000.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. This covers taxes on hotels booze and sales. Boise ID Sales Tax Rate.

Idaho first adopted a general state sales tax in 1965 and since that time the rate has risen to 6. Adams County ID Sales Tax. Raised from 6 to 7.

Simplify Idaho sales tax compliance. House Bill 436 Effective January 1 2022. What is Idahos local sales tax rate.

The sales tax rate in the state is 6 percent which ranks. Contact the following cities directly for questions about their local sales. Currently combined sales tax rates in Idaho range from 6 to 9 depending on.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Ad Lookup Sales Tax Rates For Free. The minimum combined 2022 sales tax rate for Idaho City Idaho is.

Interactive Tax Map Unlimited Use. This rate includes any state county city and local sales taxes. Idaho businesses charge sales tax on most purchases.

The current state sales tax rate in Idaho ID is 6. The Idaho City sales tax rate is. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax.

The corporate tax rate is now 6. With local taxes the total. 2022 Idaho Sales Tax Table.

Idaho has a 6 statewide sales tax rate but also has 112 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of. This is the total of state county and city sales tax rates. The Idaho ID state sales tax rate is currently 6.

For individual income tax the rates range from 1 to 6 and the number of brackets have dropped from five to four. The Boise Idaho sales tax is 600 the same as the Idaho state sales tax. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process.

The County sales tax rate is. The Idaho State Sales Tax is collected by the merchant on all qualifying sales made within Idaho State. Other local-level tax rates in the state of Idaho are quite complex.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ranking State And Local Sales Taxes Tax Foundation

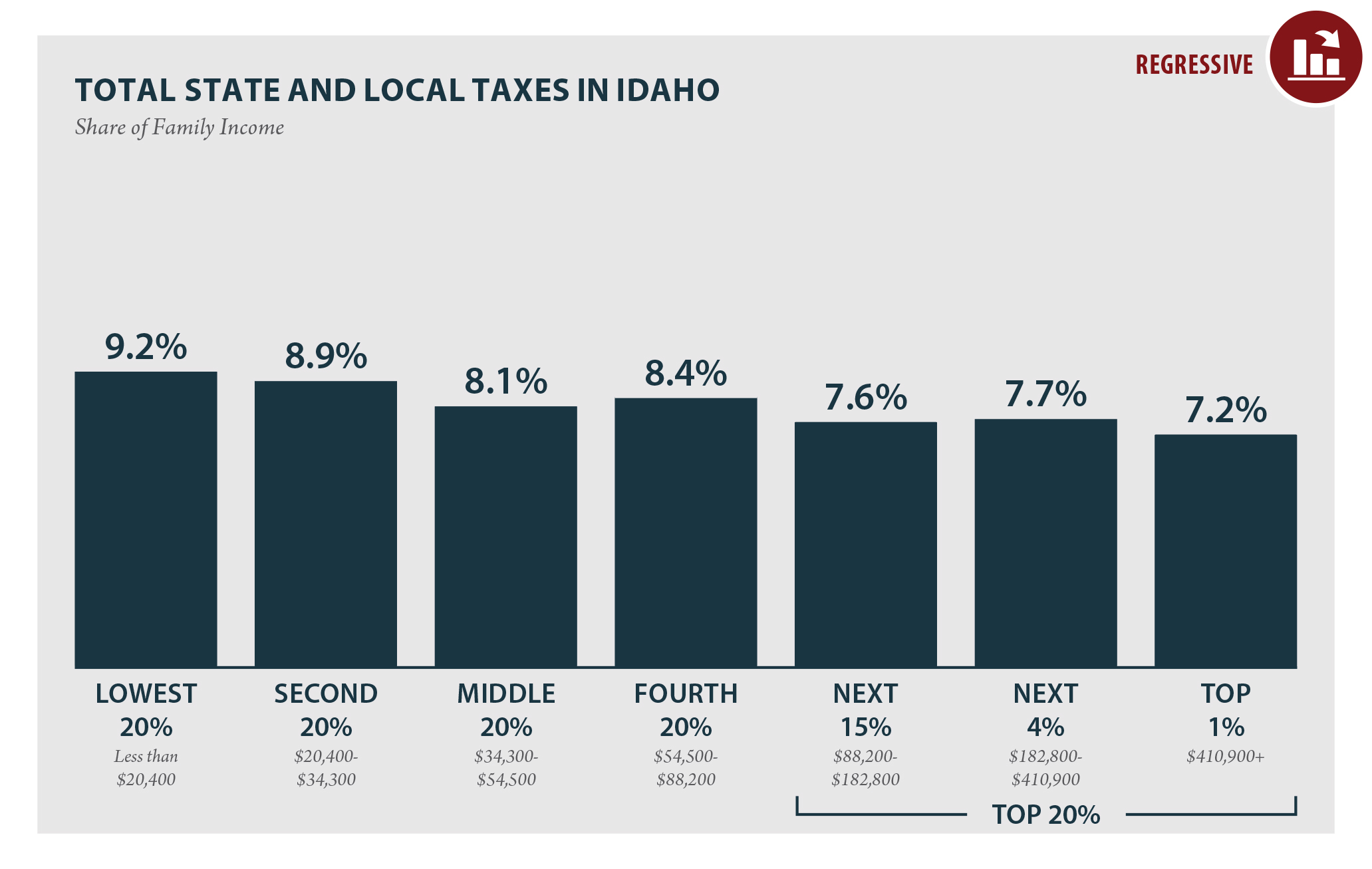

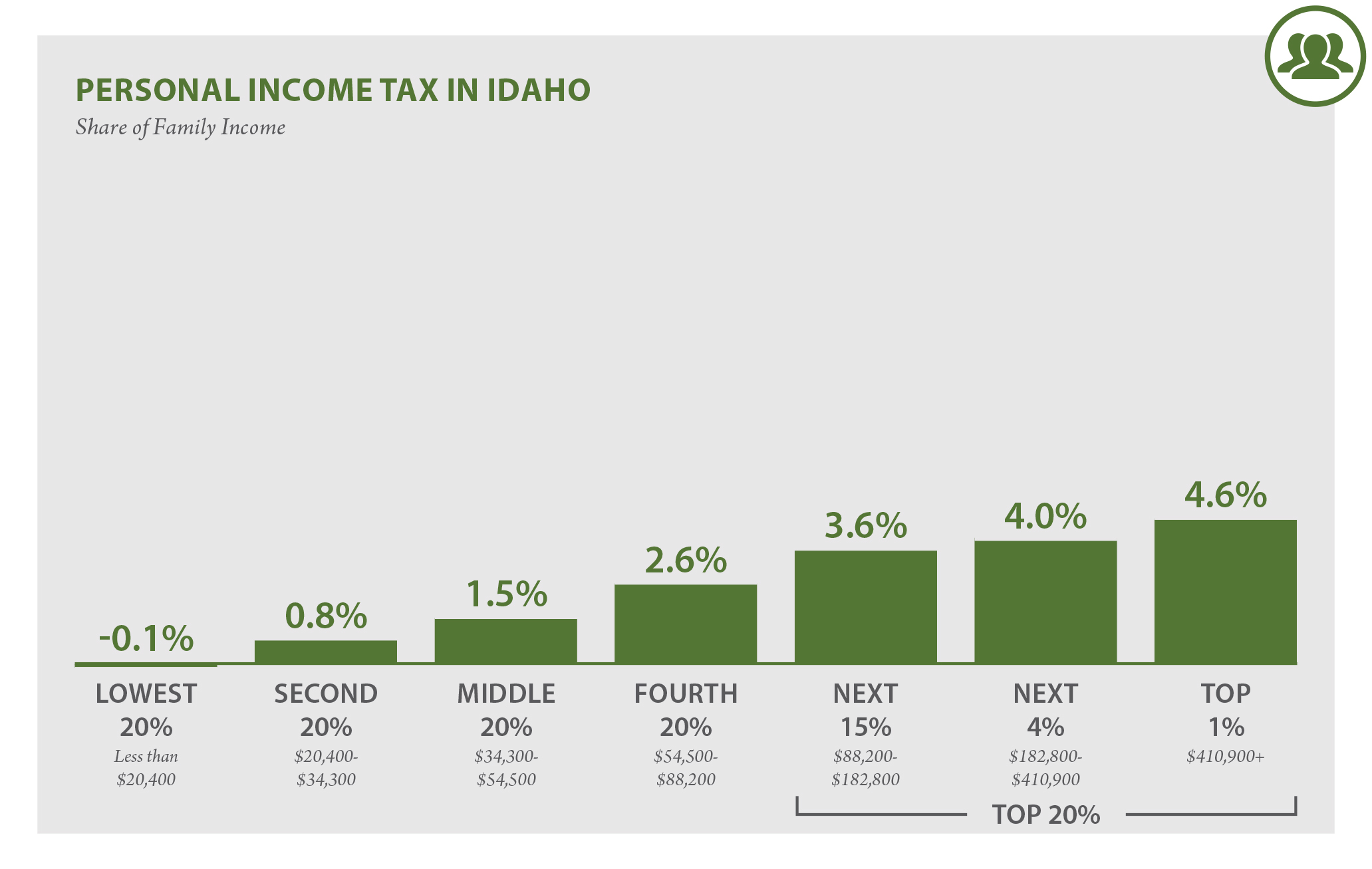

Idaho Who Pays 6th Edition Itep

Idaho State 2022 Taxes Forbes Advisor

Idaho Who Pays 6th Edition Itep

Idaho S Poor Pay Larger Share Of Income In Taxes Study Says Idaho Statesman

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

How To Charge Your Customers The Correct Sales Tax Rates

State Income Tax Rates Highest Lowest 2021 Changes

U S Sales Taxes By State 2020 U S Tax Vatglobal

Idaho Sales Tax Guide And Calculator 2022 Taxjar

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho

How To Charge Your Customers The Correct Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Idaho State Income Tax Refund Status Id State Tax Brackets

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio